Thought Leadership

The Use of AI Tooling to Comply with CSRD and ESRS

The Use of AI Tooling to Comply with CSRD and ESRS

1. Introduction – ESG and the Rise of SFR

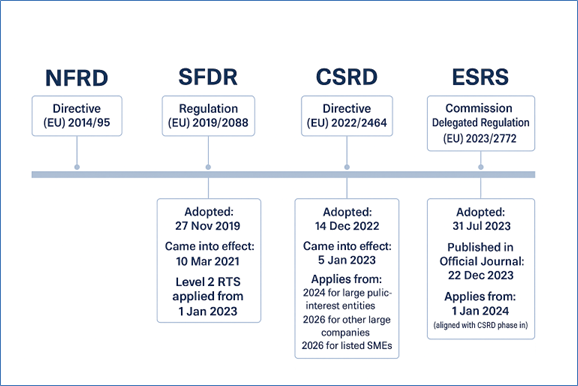

Over the past decade, the environmental, social and governance (ESG) agenda has evolved from a voluntary reporting framework into a regulated, data-driven discipline known as Sustainable Finance Reporting (SFR). This evolution has been shaped by successive EU regulatory initiatives, including the Sustainable Finance Disclosure Regulation (SFDR), the Non-Financial Reporting Directive (NFRD), and most recently, the Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards (ESRS). These frameworks have steadily expanded the scope and granularity of sustainability-related data that organisations are required to collect and disclose.

The demand for structured, auditable sustainability data has grown exponentially. Financial institutions, which have traditionally focused on quantitative financial metrics, are now required to integrate non-financial data into their reporting processes, products, and services. This shift has created new operational and technological challenges, especially for Dutch banks such as: ABN AMRO, ING, and Rabobank, which must now combine financial and non-financial data across complex portfolios and value chains.

Figure 1: Timeline showing the evolution of EU sustainability reporting frameworks.

2. Data Explosion and the Role of AI

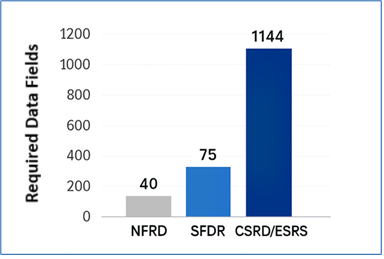

The progression from SFDR and NFRD to CSRD and ESRS has multiplied the number of data points that institutions must capture, verify, and report. According to recent EFRAG publications (European Financial Reporting Advisory Group), the ESRS framework contains more than 1,100 mandatory and optional data points, covering everything from carbon emissions and biodiversity to workforce diversity and governance indicators.

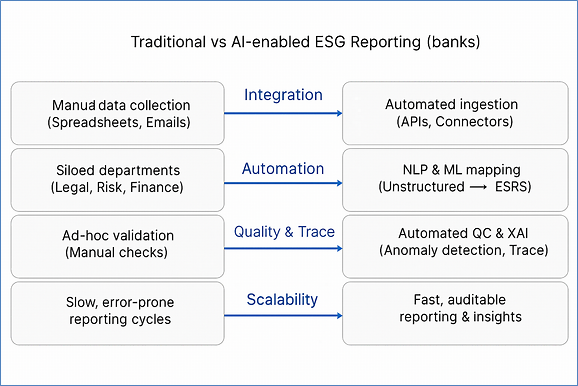

This explosion in reporting obligations makes manual data processing increasingly impractical. Artificial Intelligence (AI) technologies, including natural language processing (NLP), data extraction, and machine learning (ML), have therefore become indispensable tools in identifying, aggregating, and validating sustainability data. As Google’s Chief Sustainability Officer Kate Brandt notes, “Sustainability must be embedded within the core of business operations, not treated as a separate activity.”

Figure 2: Growth in sustainability reporting data requirements, showing the sharp increase in CSRD/ESRS compared to earlier frameworks.

3. AI in Practice – Use Cases for Dutch Banks

Dutch banks are leading examples of how AI can be deployed to enhance ESG compliance. At ABN AMRO, machine learning models assist in interpreting unstructured sustainability data from corporate clients, while ING has invested in AI-driven climate-risk models that integrate ESG factors into credit assessments. Rabobank, known for its cooperative heritage and strong ESG profile, applies AI to monitor sustainability metrics within its food and agriculture portfolio. Mary Barra, CEO of General Motors, echoes this broader responsibility: “True leadership in business today means going beyond financial metrics to measure success. It requires us to look at how our actions impact people, the planet, and future generations.”

These examples demonstrate that AI not only supports compliance but also strengthens strategic decision-making by improving data quality, consistency, and timeliness. According to Colin Mayer of Oxford University, “The purpose of business is to produce profitable solutions to the problems of people and planet.”

Figure 3: Comparison between traditional ESG reporting processes and AI-enabled reporting.

4. Governance, Human-in-the-Loop, and EU Legal Compliance

The integration of AI into ESG reporting must be guided by robust governance and compliance principles. Under the EU AI Act, financial institutions must ensure human oversight (‘human-in-the-loop’) for all high-impact AI processes. This ensures that automated insights are subject to expert validation and that decisions remain accountable.

AI systems used in ESG reporting must adhere to the principles of transparency, explainability, and proportionality. This includes maintaining audit trails for AI-driven data extraction and transformation steps, as well as clearly documenting methodologies, model limitations, and risk mitigation measures. Institutions such as the ECB and DNB have emphasised that ethical AI deployment is essential for maintaining trust in the financial system.

5. Conclusion and Outlook

The transformation from voluntary ESG disclosures to mandatory, standardised reporting under the CSRD and ESRS represents a turning point for the European banking sector. For Dutch institutions such as ABN AMRO, ING, and Rabobank, compliance now extends far beyond meeting regulatory expectations: it requires a complete rethinking of how sustainability data is captured, validated, and used to inform strategy.

AI has emerged as a key enabler of this transformation, automating the collection, analysis, and validation of ESG data while maintaining auditability and control. However, deploying AI requires strong ethical and governance frameworks that ensure human oversight, accountability, and compliance with EU law.

Professional support is often required to operationalise these frameworks effectively. CubeMatch and its branches, including its headquarters in Ireland and offices in the UK, the Netherlands, and Germany, assist financial institutions in integrating AI-enabled ESG governance into their reporting processes. With expertise in strategic change, regulatory compliance, digital transformation, and data-driven solutions, CubeMatch helps ensure both regulatory adherence and organisational resilience, leveraging its global presence to deliver tailored, expert-led support to meet the demands of highly regulated environments.

In the years ahead, banks that successfully combine technological capability with ethical governance will not only comply with CSRD and ESRS requirements but also strengthen their strategic positioning in the sustainable finance ecosystem.

If you’d like to know more about CubeMatch ESG-related services, get in touch today with our team http://cubematch-144313631.hs-sites-eu1.com/smeseries3 !

Disclaimer

This article is based solely on publicly available information from sources such as annual reports, regulatory publications, and official EU documentation. No proprietary or confidential data has been used.

References

ABN AMRO Bank N.V. (2025). *Integrated Annual Report 2024 – Our impact on society.* ABN AMRO. https://www.abnamro.com/en/about-abn-amro/annual-report

ABN AMRO Bank N.V. (2025, April 24). *Our first CSRD annual report.* ABN AMRO Newsroom. https://www.abnamro.com/en/news/our-first-csrd-annual-report

Barra, M. (2022, April 28). *GM’s vision for an all-electric future.* *General Motors Newsroom.* https://media.gm.com/media/us/en/gm/home.detail.html/content/Pages/news/us/en/2022/apr/0428-barra-speech.html

Brandt, K. (2021, October 19). *Sustainability at the core of business operations.* *Google Sustainability Blog.* https://sustainability.google/blog/sustainability-core-business/

CubeMatch Group. (2024). *About us – Delivering regulatory, digital, and data-driven transformation.* CubeMatch Ireland Ltd. https://www.cubematch.com

De Nederlandsche Bank (DNB). (2023). *Good practices for climate-related risk management and disclosure.* DNB. https://www.dnb.nl/en/publications/publication-dnb-good-practices-climate-risk/

European Central Bank (ECB). (2023, November 23). *ECB sets out supervisory priorities 2024–2026.* ECB Banking Supervision. https://www.bankingsupervision.europa.eu/press/pr/date/2023/html/ssm.pr231123~6a3a8eb1de.en.html

European Commission. (2023). *Corporate Sustainability Reporting Directive (Directive (EU) 2022/2464).* *Official Journal of the European Union.* https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32022L2464

European Commission. (2024). *Artificial Intelligence Act (Regulation (EU) 2024/1689).* *Official Journal of the European Union.* https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32024R1689

European Financial Reporting Advisory Group (EFRAG). (2023, July 31). *European Sustainability Reporting Standards (ESRS Set 1).* EFRAG. https://xbrl.efrag.org/e-esrs/esrs-set1-2023.html

European Financial Reporting Advisory Group (EFRAG). (2024, June 9). *Finalised ESRS implementation guidance documents (IG 1–3).* *XBRL News.* https://www.xbrl.org/news/efrag-finalises-three-esrs-implementation-guidance-documents/

ING Group N.V. (2025, March 6). *ING publishes 2024 Annual Report.* ING Press Releases. https://www.ing.com/Newsroom/News/Press-releases/ING-publishes-2024-annual-report.htm

ING Group N.V. (2024, September 19). *Five things to know from our Climate Progress Update 2024.* ING Newsroom. https://www.ing.com/Newsroom/News/Five-things-to-know-from-our-Climate-Progress-Update-2024.htm

Mayer, C. (2018). *Prosperity: Better business makes the greater good.* Oxford University Press.

Rabobank Group. (2025, March 7). *Integrated Annual Report 2024 – Growing a better world together.* Rabobank. https://www.rabobank.com/en/about-rabobank/annual-reports

Rabobank Group. (2024). *Sustainability & Climate Report 2024.* Rabobank. https://www.rabobank.com/en/about-rabobank/reports

Author: Corné F.W.M. Heijmans, Business Consultant, CubeMatch Benelux

// EXPLORE Thought Leadership

Every change starts with a conversation.

Let's chat about how CubeMatch can drive your transformation.

Get in touch to see how we can work together to make a difference for your business.