"Since corrupt people unite amongst themselves to constitute a force, then honest people must do the same." — Leo Tolstoy

Challenge

Current rising issues such as Money Laundering, Fraud, Market Abuse, Bribery and Corruption, Modern Slavery and Terrorist Financing are affecting financial institutions and their clients daily. The impact of this can lead to reputational damage, fines and individual accountability for senior management.

“The banking industry spends billions of pounds each year fighting fraud, but criminals continue to commit this crime and losses exceeded £1 billion for another year running. That is equivalent to around £2,300 stolen every minute of last year. In all its forms, fraud accounts for over 40 per cent of crimes committed in England and Wales.”

UK Finance - The definitive overview of payment industry fraud in 2022

Serious & Organised Crime generates approx €205B (US$220B) a year (2020/2021) representing approx 1.5%/1.4% of EU GDP. The value of assets confiscated by Europol from criminal networks is “a drop in the ocean”, at below 2% (€4.1B (US$4.4B). This is the result of “an ever-expanding web of corruptors and corrupted enabling criminals to have access to information and power with (sic) the capability to launder industrial levels of illicit profits”.

EUROPOL Report 11 September 2023

Financial crime investigations are currently carried out in silos and recorded in different systems across the same organisation. Internal recording of escalations, investigations and external reporting is often limited to spreadsheets and internal databases with little reporting or analysis. Intelligence sharing between departments, business lines, and regions is not always possible. This is where AECIS can play an active role by enabling collaboration across financial sectors and with other industries.

Solution

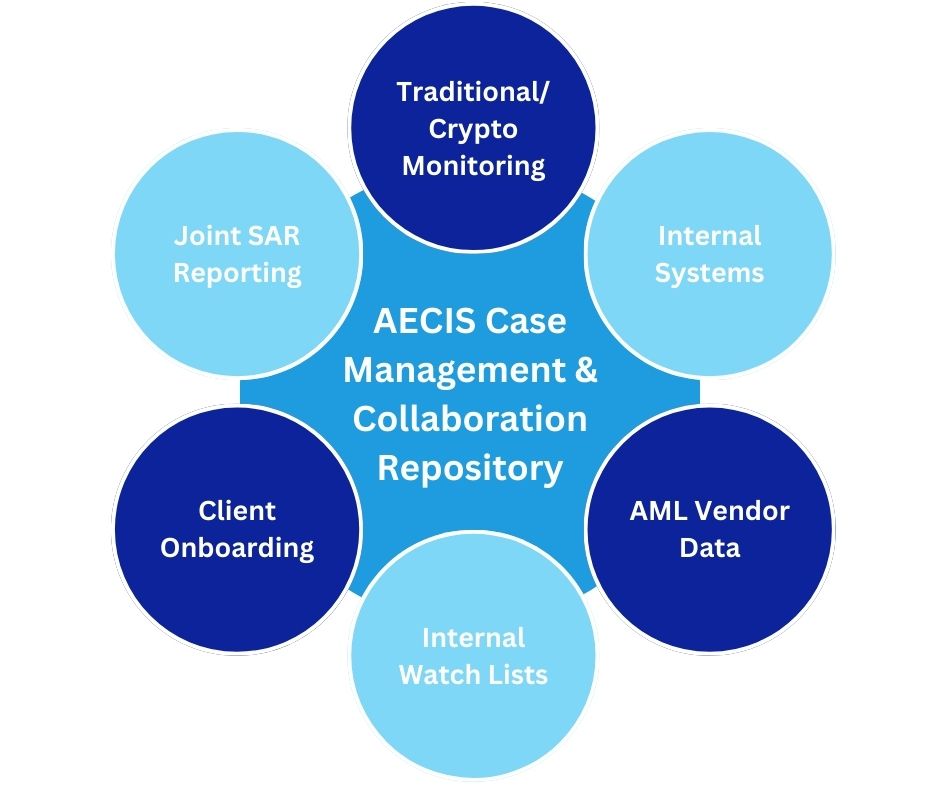

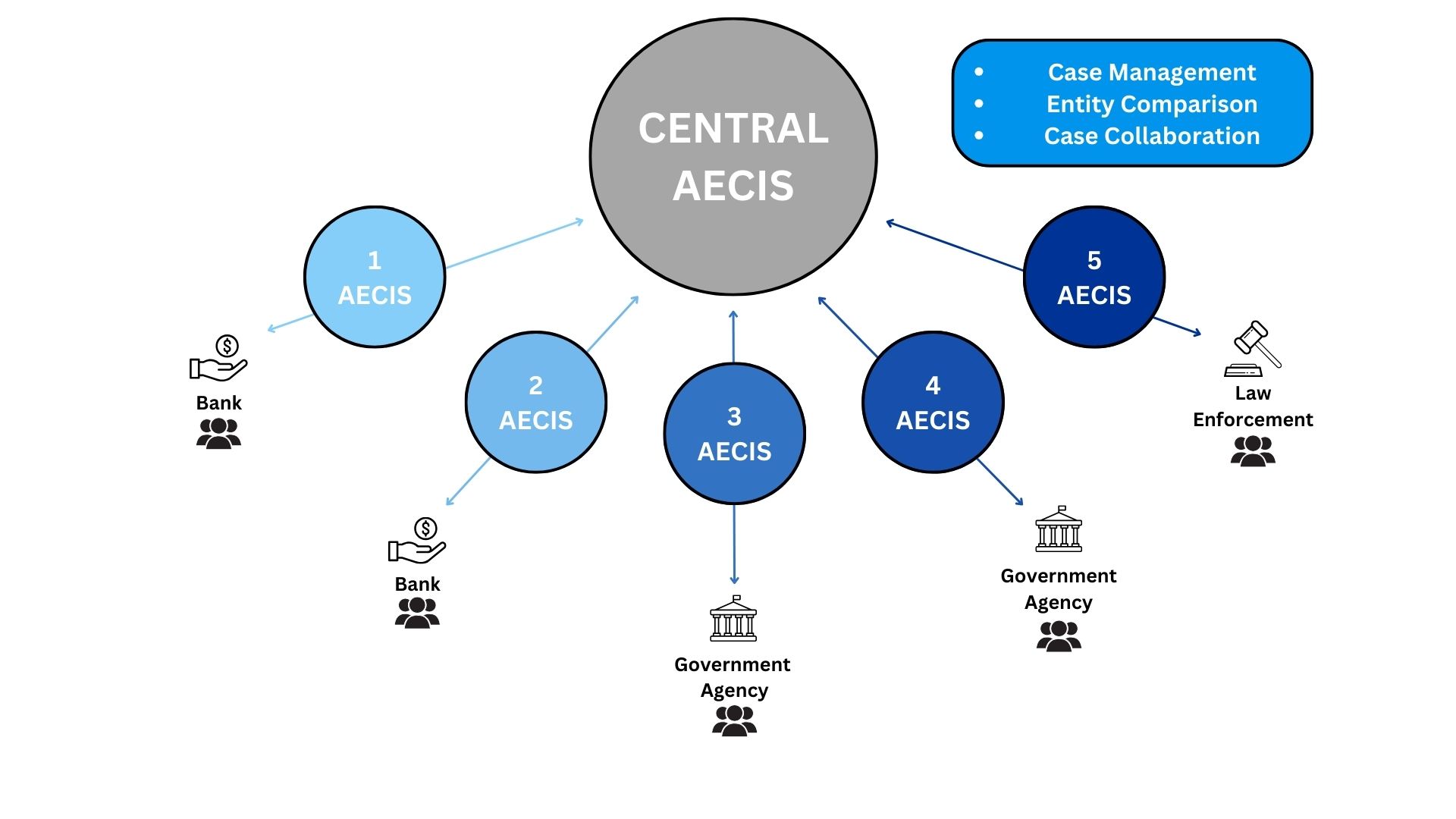

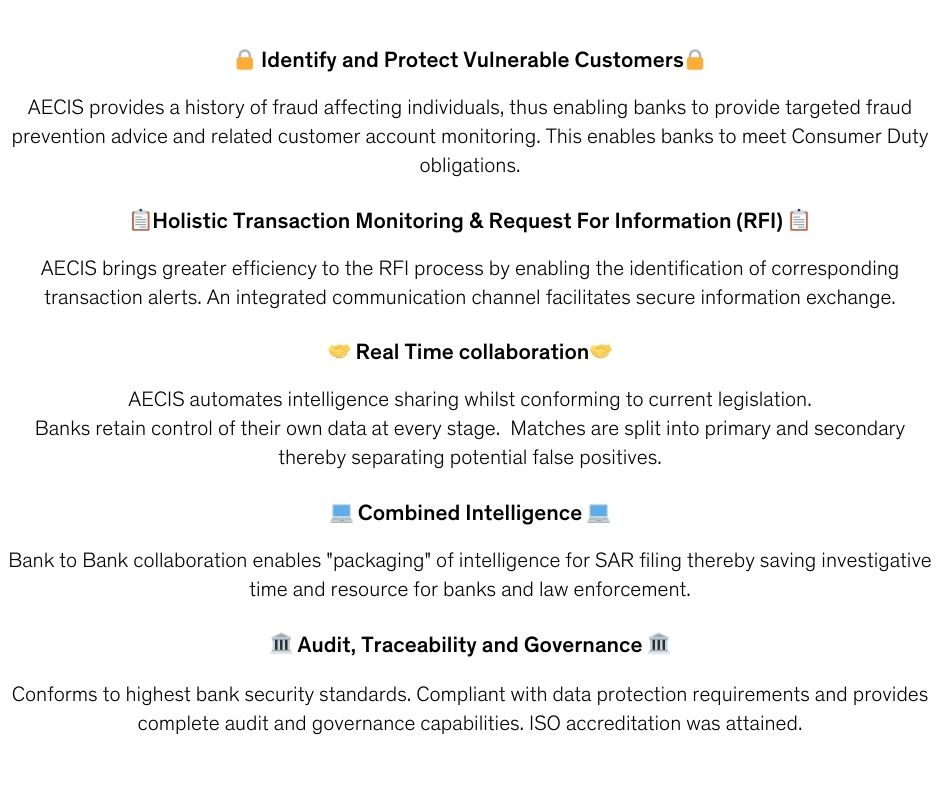

AECIS is a unique Case Management System which is compatible with Onboarding & Transaction Monitoring systems. It is also a multi-tenant Industry/Sector Agnostic platform designed for both Internal & External intelligence sharing. It incorporates a Privacy Enhancing network of databases incorporating the AECIS Case Management & Collaboration Platform where data owner identities are anonymized and only disclosed at the end user discretion.

Investigators are alerted to personal data that has been found in historical case records and only precisely matching case/entity data entries are displayed. An Integrated ‘Investigation Group’ function allows compliant intelligence sharing and results in centralised intelligence facilitating traceability, audit and governance.

AECIS sits at the centre of the Anti-Financial Crime Ecosystem

Collaboration Enabling Technology

- Data Flow and bank to bank communication is via API/SFTP

- Browser based user interface

- AECIS databases are logically separated

- CENTRAL database identifies matching data

- Secure communication channel with Law Enforcement

How does it work?

Key functions

External Intelligence Sharing:

- Users retain complete control of their own identities and entity data.

- Suspicious documents can be shared externally.

- Holistic Transaction Monitoring capability across multiple FIs.

- Specific workflow for Money Laundering/Terrorist Financing cases.

- Traditional and Crypto Transaction Monitoring capabilities

Joint Investigation:

- Joint Investigation Groups enable sharing between FIs

- Each FI controls when and who to share with

- Enables packaged intelligence and effective use of Joint SAR process.

Internal Case Management:

- Comprehensive investigations workflow

- Uses case and transaction data to connect Current & Historical Investigations

- Compatible with internal systems and third-party AML Vendor services

Comprehensive workflow

To learn more about AECIS please contact Chris Anderson: Chris.anderson@cubematch.com.

Patent No: US 10,757,142 B2

#AECIS